Self-employed!

Don't let the DBA Act derail your career. Sportverloning ensures that you and your client can work together risk-free and without hassle.

Save time and stress—let us handle your payrolling!

Work as a self-employed professional with the certainty of an employer. Sportverloning handles your invoicing, paychecks, remittances and insurance in one platform. You focus on your assignment; we ensure everything is DBA-proof and administratively taken care of, without your own KvK or VAT number. That's worry-free work.

8,7

Based on 327

reviews on Klantenvertellen

116.584

self-employed professionals rely

on Sportverloning

2011

Over 10 years of expertise

in payrolling

How Sportverloning works for the self-employed

Sportverloning in 80 seconds

Make the right choice

Freelance worry-free with our memberships

€ 0,-

/ maand

Basic

No cure no pay

Voor starters of incidentele opdrachten:

You pay 6% commission per payrolling

Your invoicing and taxes handled

Excellent and affordable disability insurance (AOV)

DBA check including fiscal indemnity

Our users rate us 8,7

Meest gekozen membership

€ 75,-

/ maand

Premium

Arranged carefree

Voor zelfstandigen met vaste opdrachten:

You pay 3% commission per payrolling

Includes additional insurance

Unlimited training with GoodHabitz

Outings to Blijdorp, Artis or Duinrell

Fixed monthly tax-free allowance

€ 175,-

/ maand

All-in

Perfectly arranged

Voor professionals die zekerheid willen:

You pay no commission per payrolling

Includes comprehensive insurance

Insured against false self-employment

Your invoice advanced for just 2%

VIP tickets for concerts and football

What do we offer you?

Why choose Sportverloning?

Easy and fast

All-in-one platform

One clear and efficient platform that handles all your invoicing, taxes, remittances and protections simply and correctly. Stuck for a moment? Our customer service helps you right away—personal, expert and fast.

For every self-employed professional

Memberships that suit you

Whether you work occasionally, have regular assignments or want to arrange everything professionally, there's always a membership that suits you. All memberships offer fiscal certainty, fast payout and personal support. As a paid member you also benefit from discounts on our commission and factoring, receive free additional insurance, and get chances for exclusive outings to theme parks, concerts and football matches.

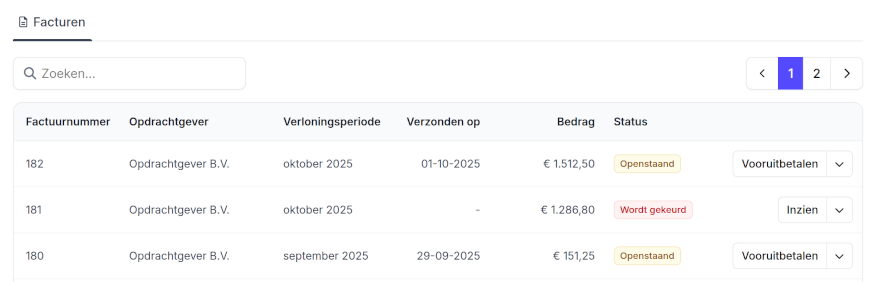

No surprises

For clients

If you receive an invoice from Sportverloning, you know everything is properly arranged. Each invoice includes an overview of the relevant insurance, a fiscal indemnity and the contractor's DBA check to prevent false self-employment. We also hold a current payment behavior statement from the Tax Administration and an assurance report for VAT and payroll tax by an independent accountant. Everything is arranged fully transparently and fairly—just as it should be.

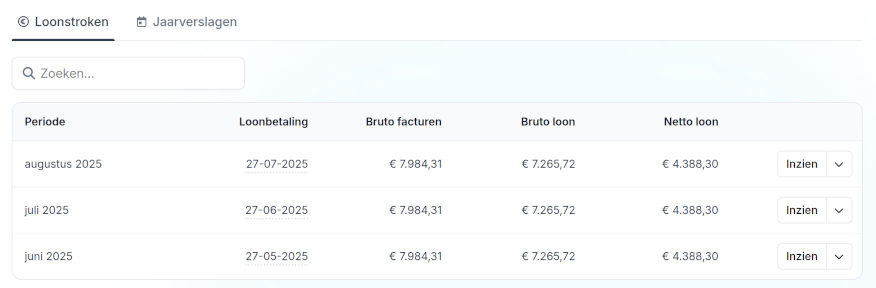

Well arranged

Payout within one business day

After your client pays, we pay your net amount within one business day. This way VAT, payroll tax and the Zvw contribution are neatly remitted to the Tax Administration in advance, so you never face fiscal surprises.

Reliable

10+ years of experience

Sportverloning has existed since 2011 and now supports 116.584 self-employed professionals in the Netherlands. With over 10 years of experience and a 8,7 rating on Klantenvertellen.nl, you're assured of a partner that handles everything reliably, carefully and transparently.

Our partners

More benefits together

At Sportverloning you benefit from the power of the collective. For example, we have our own Schenkkring that supports self-employed people in case of illness or misfortune, and we work with insurers, banks and partners to offer benefits you won't get anywhere else.

Take control

Explore the possibilities without obligation

Sign up in 10 seconds and see how simple it is. There are no strings attached.